Understanding Competitive Exness Fees Your Guide to Maximizing Trading Profitability

Understanding Competitive Exness Fees: Your Guide to Maximizing Trading Profitability

When embarking on the journey of online trading, one of the key components that traders must understand is the fee structure imposed by their chosen broker. Competitive Exness fees play a crucial role in determining overall profitability. In this article, we will dive deep into the fee structure of Exness, analyze its competitiveness compared to other brokers, and provide you with essential tips on managing your trading costs effectively. For more insights on this topic, consider checking this link: Competitive Exness Fees http://www.heeda.org/incentivo-de-registro-de-exness-5/

What Are Exness Fees?

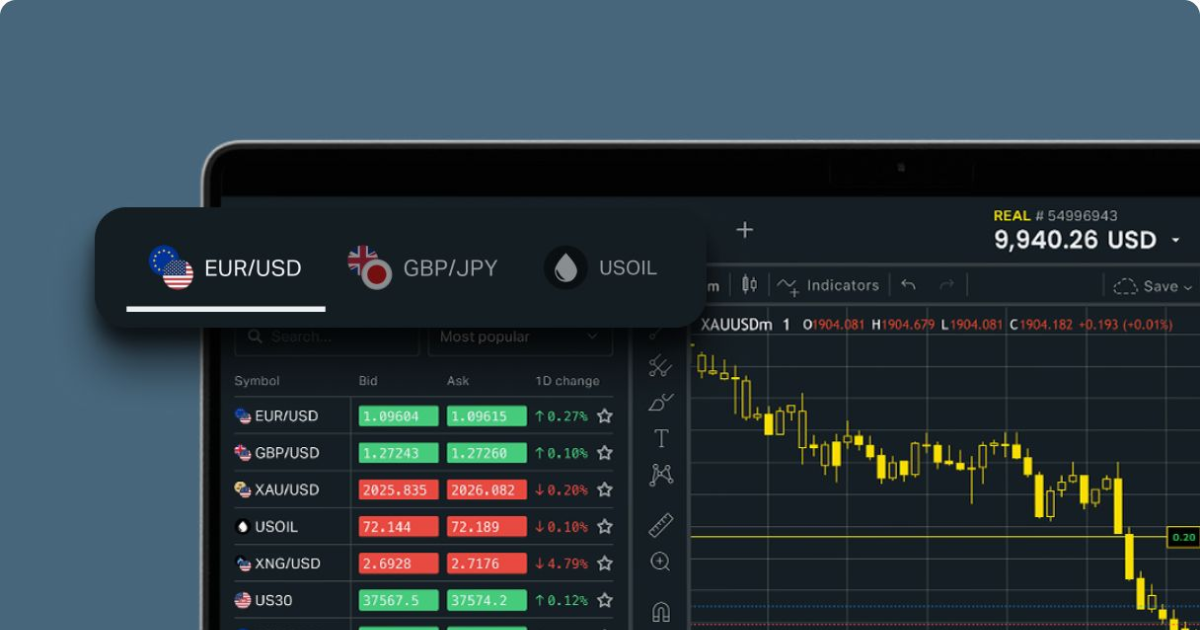

Exness, like other brokers in the online trading industry, charges various fees associated with trading activities. These fees can significantly affect your trading strategy and overall profitability. Common fees associated with Exness include spreads, commissions, overnight fees, and withdrawal fees.

Types of Fees Charged by Exness

1. Spreads

Spreads represent the difference between the buying and selling prices of an asset. Exness offers both fixed and variable spreads depending on the trading account type you choose. Variable spreads can fluctuate based on market conditions, while fixed spreads remain constant, providing certainty for traders. Understanding the spread is crucial as tighter spreads can lead to greater potential returns on your trades.

2. Commissions

Some account types at Exness charge commissions on trades. Typically, these accounts offer lower spreads, allowing traders to benefit from lower overall costs if they are active traders placing many transactions. It is essential to calculate whether an account with a commission structure would be more beneficial than one with a higher spread but no commission.

3. Overnight Fees (Swap Rates)

Overnight fees, also known as swap rates, are charged when a position is held overnight. These fees can vary based on the asset being traded and the direction of the trade (buy or sell). Traders who frequently hold positions overnight should consider these fees as they can accumulate and impact long-term profitability.

4. Withdrawal Fees

While Exness offers a range of withdrawal options, certain methods may incur fees. It’s crucial for traders to review the withdrawal policy and ensure their chosen method aligns with their financial goals to minimize unnecessary costs.

Competitive Analysis of Exness Fees

In order to gauge whether Exness offers competitive fees, it’s essential to compare them with other brokers in the market. Generally, the key factors to consider include spreads, commissions, and overall trading costs.

Many brokers charge higher spreads and commissions, especially for lesser-known or less regulated brokers. In contrast, Exness strives to maintain a competitive edge through transparent pricing and a variety of account types. For instance, with its Standard and Pro accounts, Exness caters to both beginners and experienced traders by offering low-cost options suited to their trading style and frequency.

Determining the Right Account for Your Trading Style

Choosing the right account type is vital for minimizing fees and maximizing profitability. Exness offers different account types, each with distinct features:

- Standard Account: Ideal for beginners, this account provides a user-friendly interface with no commission fees and competitive spreads.

- Pro Account: Suitable for experienced traders, this account features tight spreads and a commission structure that benefits high-frequency traders.

- Zero Account: This account type offers no spread and charges a small commission, appealing to scalpers and those seeking to capitalize on small price movements.

Tips for Managing Your Trading Costs with Exness

To successfully manage fees and maximize your profits while trading with Exness, consider implementing the following strategies:

- Choose the Right Account: Analyze your trading habits and select an account that aligns with them to minimize costs effectively.

- Take Advantage of Promotions: Exness occasionally offers promotional deals that can help reduce fees. Stay updated to maximize these offers.

- Use Spread Comparison: Regularly compare spreads on different account types to ensure you are taking advantage of the most favorable conditions.

- Monitor Your Trading Frequency: If you’re an active trader, consider commission-based accounts that may offer better overall pricing.

- Educate Yourself on Fee Structures: Staying informed about how various fees work will allow you to trade with an informed strategy, keeping your costs in check.

Conclusion

Understanding and navigating the competitive Exness fees is essential for optimizing your trading strategy and achieving your financial goals. By taking the time to analyze the fee structure, choosing the right account, and actively managing your trading costs, you can enhance your trading experience with Exness. As you continue your trading journey, remember to stay informed about any changes to fee structures that may affect your trading decisions.

Comentarii recente