Underdog Dream deposit incentive to own Lakers against Celtics: $step one,000

Articles

- Jarryd Anderson to go over Financial Mergers during the CFA’s Financial Characteristics Appointment

- USF Contribution Grounds Dips To 32.8 Per cent To possess Next Quarter Out of 2024

- ‘Have not carried his load’: Trump manages to lose beauty of $5M Age. Jean Carroll defamation governing

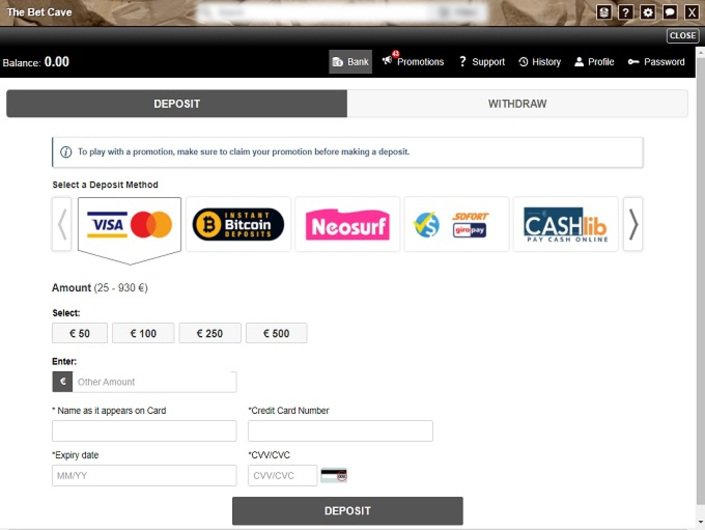

- The place to start Playing on the a great $step 1 Deposit Gambling establishment

Which Financial Reviews brings a track record of mutual places and you will teaches you how changes in brokered deposit legislation generated him or her more inviting to help you banks and you may, therefore, how reciprocal deposits help the effective put insurance policies limit. Its increased have fun with within the banking turmoil from 2023 shows that it innovation will be made use of once the interest in covered dumps grows. The new widescale use of reciprocal dumps have effects on the effectiveness of your own put insurance coverage system one sustain then research. Since the evident escalation in mutual put include in 2023 is actually driven from the disorder, there are also expanded-work on fashion inside deposits having enhanced the newest show out of places which might be uninsured which means have raised the brand new pond of places that could be produced reciprocal deposits. Profile 3 account the real property value the newest deposit insurance coverage limitation for just one account proprietor time for 1934. Dining table dos records the newest fraction away from banking institutions whereby the brand new $5 billion or 20 percent away from obligations limit on the therapy from nonbrokered dumps is actually binding.

Jarryd Anderson to go over Financial Mergers during the CFA’s Financial Characteristics Appointment

Simultaneously, I can share some original courses discovered once we review for the instantaneous wake for the episode. 40 The brand new special research rate, ft, and you will expected outcomes in this final laws mirror one amendments to help you research at the time of November dos, 2023, to your reporting months you to definitely concluded December 30, 2022. Some comments recommended solution accounting actions, including restructuring the fresh unique evaluation because the a prepaid expenses amortizable more than a good multiple-12 months period. The new FDIC rejected for example proposals, listing you to definitely including treatment manage reduce the you to-day affect income but also remove liquidity by the full amount of the new unique analysis from the percentage, and thus suppressing the school’s power to absorb unexpected setbacks while also offering borrowing from the bank so you can the newest economy. The Monetary Characteristics Category is recognized as a top destination for a general directory of subscribers regarding the economic features globe for the its most significant matters.

USF Contribution Grounds Dips To 32.8 Per cent To possess Next Quarter Out of 2024

While the demise from Silicone polymer Valley Financial and you can, recently, Very first Republic broken the newest reputation of local banking companies, it’s got actually boosted people’ reliance upon highest federal banking institutions for example Goldman, bringing an influx from places lately, reports inform you. Authoritative AML/CFT administration procedures are requests granted by FDIC up against insured loan providers and you can private participants. The brand new FDIC issues formal tips, including Concur Requests, pursuant in order to Point 8 of the Federal Put Insurance coverage Work.

‘Have not carried his load’: Trump manages to lose beauty of $5M Age. Jean Carroll defamation governing

When you has form of choice to have online game, we advice offered games as one of their hallmarks for buying a no-deposit incentive. Thus, more the fresh promotions in addition to sales for mobile profiles is actually growing. Be it mobile exclusive No-deposit bonuses or other benefits, gambling enterprises are prone to have something special waiting for you for professionals on the run. Inside February 2022, Saudi Arabia placed $5 billion to the Main Financial out of Egypt, getting complete dumps in the Kingdom in order to $10.step three billion. The cash assisted balance out Egypt’s foreign exchange reserves once international trader distributions spiked after the battle inside Ukraine.

The brand new desire didn’t have the new implied impression.16 A lot of SVB’s venture capital users got to social networking to craving businesses to https://mrbetlogin.com/triple-magic/ go its deposit accounts of SVB.17 Towards the end throughout the day to your Thursday, February 9, 2023, $42 billion inside the places got kept the financial institution. On the Depository Institutions Deregulation and you can Economic Control Act from 1980, Congress reaffirmed the Federal Set aside is to provide a competent nationwide payments system. The newest work sufferers the depository establishments, not only representative industrial financial institutions, so you can set aside conditions and you can offers her or him equivalent access to Set aside Financial commission characteristics.The new Federal Set aside plays a part in the nation’s retail and you will general costs options by providing financial characteristics so you can depository institutions.

The place to start Playing on the a great $step 1 Deposit Gambling establishment

The main proportion out of uninsured put stability made worse put work with vulnerabilities and made each other financial institutions susceptible to contagion effects on the rapidly developing financial improvements. You to definitely obvious takeaway out of previous situations is the fact hefty reliance upon uninsured dumps brings exchangeability dangers that will be nearly impossible to deal with, particularly in now’s ecosystem in which currency can also be move away from establishments having incredible rates in response to help you reports increased as a result of social networking streams. In an effort to quell the fresh rising inquiries of one’s bank’s depositors and you can borrowers, the chief Government Manager out of SVB urged venture capital customers in order to be patient and maintain their deposits in the business.

- Next, the stayed better-capitalized and you will very liquid, nevertheless the declaration along with showcased a key fatigue in the raised membership from unrealized losings to the investment securities due to fast expands inside business interest levels.

- Unrealized losings for the available–for–sale and you will kept-to-maturity securities totaled $620 billion in the 4th quarter, off $69.5 billion from the prior quarter, due to some extent to lessen financial costs.

- The newest FDIC rates that the rates on the DIF of resolving SVB becoming $20 billion.

- For the April 7, 2022, CIBC investors approved a-two-for-one display separated (Show Split up) from CIBC’s given and a good preferred shares.

- Inside the an excellent Tadawul report, the firm revealed that its web money increased due to the increased usage price away from short and you will long-identity local rental locations.

The newest views people share within the Financial Comments is actually theirs and not necessarily those of the brand new Federal Set aside Lender out of Cleveland or perhaps the Panel from Governors of your Government Put aside Program. It report and its particular analysis are susceptible to modify; kindly visit clevelandfed.org for position. Former President Donald Trump often post a far more than $5.5 million dollars put as he appeals a decision within the choose out of Elizabeth.

Certainly federal banks, the common savings account give is actually lower than 1 percent, that produces Apple’s offer extremely attractive. Goldman’s individual large-produce checking account, housed under the individual banking section, Marcus, now offers a somewhat straight down get back out of step three.90 %. While the bank account is actually labeled having an apple image, Goldman Sachs ‘s the real bank holding and handling customers dumps.

Changes have been made to provide instructions to own amending SOD studies just after first distribution. After the initial publication out of SOD questionnaire overall performance by Sep 31, 2023, amendments would be reflected inside unexpected position thereafter. Nonetheless, Fischer or any other defendants declare that their violent steps geared towards closing Congress of depending electoral ballots, in addition to breaking the brand new Capitol strengthening and you can attacking law enforcement, just weren’t meant to be shielded underneath the legislation. And although Trump isn’t an event for the focus, Fischer’s petition notes one a couple of five government costs Trump confronts to possess their character regarding the insurrection stem from it law. “Promoting funding and you can financial opportunity inside underserved communities is vital to achieving the You.S.’s possibility to enable development that is as well as comprehensive.

Comentarii recente