Latest Lender Downfalls and the Federal Regulating Effect

Content

All the organizations having branch workplaces have to complete the newest questionnaire; institutions with only a central office is excused. MMFs was and active buyers on the loans given because of the Government Financial Banking institutions (FHLBs), boosting their holdings of FHLB loans ties from 9% in order to 12% out of full financing possessions in the 1st one-fourth out of 2023. MMFs experienced cumulative inflows out of $step 1.2 trillion inside the 2023, the largest to your number. U.S. money market fund (MMF) are an essential way to obtain quick-identity money to the economic climate while they invest highest cash stability and you will keep mostly small-identity opportunities.

Point 482.—Allowance of cash and Write-offs Among Taxpayers

Dividends on the half a dozen-month licenses are made on the a straightforward (not substance) interest foundation and they are paid if certificate matures. We rated Quontic Financial Certification away from Put very to discover the best three-year Dvds because the their about three-year certificate pays step three.25% APY—perhaps one of the most aggressive rates for that term solution. Quontic’s costs to the all the terms are close to the better efficiency available, plus the on the web lender makes it simple to start a Video game within a few minutes. High much time-name production for the Very first National Financial’s Cds can be suitable for those people trying to lock in income more than long stretches.

Bidding to possess Silicone Valley Private Bank and you will SV Link Bank signed for the March twenty-four. The fresh FDIC received 27 offers of 18 bidders, as well as offers beneath the entire-bank, private financial, and you may resource profile options. On the February 26, the brand new FDIC accepted Very first-Residents Bank & Believe Team (First-Citizens), Raleigh, North carolina, because the profitable buyer to assume the places and you may fund out of SV Link Financial. The new 17 previous twigs from SV Link Bank within the Ca and Massachusetts reopened while the First-Citizens on the March 27.

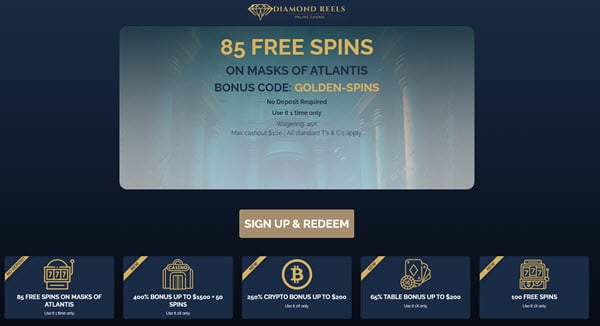

$1 Put Gambling establishment Info

Team at the Board as well as the Put aside Banks make a wide directory of analytical performs one to examines the condition of the new You.S. bank operating system having a specific work at growing dangers which is built to offer context to own policymakers and group (understand the „More Subject areas” section). A review of both internal and external topic signifies that group identified an array of emerging things, like the impact of ascending rates to the https://vogueplay.com/uk/cruise-casino-review/ securities valuation and you may prospective put affects, all of and therefore proved associated for SVB. SVBFG’s fast incapacity will likely be connected straight to its governance, exchangeability, and interest rate risk-government inadequacies. A full panel out of directors failed to receive adequate information out of administration from the risks in the SVBFG and you will didn’t keep administration responsible. Such as, guidance reputation one to government delivered the brand new panel don’t rightly emphasize SVBFG’s liquidity items until November 2022 even after deteriorating conditions.

New revealing. Fearless news media. Delivered to you.

Generally, the brand new remuneration is viewed as to be paid back when a created statement such as the resources is furnished on the employer by the staff pursuant to section 6053(a), because the chatted about lower than. 1 Pursuant to help you § 433(h)(3)(A), the next portion rate determined lower than § 430(h)(2)(C) is utilized to search for the current responsibility out of an excellent CSEC plan (which is used so you can determine the minimum level of a complete financing restriction less than § 433(c)(7)(C)). Any deposit of cash, the function at which would be to hold the performance away from an excellent home-based leasing agreement or one part of such as a binding agreement, aside from in initial deposit that is exclusively a deposit from lease, will be governed from the specifications of the point. (1) The fresh written report itemizing the reason why for the storage of every portion of the security put need to be with a complete commission of your difference in the safety deposit and the count retained. The brand new property manager shall shell out for around five % yearly attention to the people ruin, defense, clean up otherwise landscape deposit required by a property owner away from a renter. The fresh property manager will possibly spend the money for attention per year or material the brand new interest a-year.

What the results are pursuing the half dozen-week several months?

The brand new 40 previous branches out of Signature Bank began operating under Flagstar Lender, Letter.An excellent., for the Saturday, March 20. Depositors away from Signature Bridge Financial, besides depositors linked to the new digital investment banking business, instantly turned into depositors of your own acquiring institution. The brand new getting organization did not bid to the deposits of them electronic asset banking customers.

The fresh FDIC offers those people dumps, approximating $4 billion, directly to those consumers. My testimony today usually define the new situations leading up to the fresh failure out of SVB and Signature Financial and also the items and you may issues one to caused the decision to utilize the expert in the FDI Act to safeguard all the depositors when it comes to those financial institutions following the this type of problems. I could along with talk about the FDIC’s evaluation of your own present state of your You.S. financial system, and therefore stays voice despite previous situations. Concurrently, I could show some original courses read once we review for the instantaneous aftermath of this episode. Financial institutions having assets regarding the $ten billion to $a hundred billion diversity are monitored in the Regional Banking Organization, otherwise RBO, portfolio. Financial institutions having assets from below $10 billion is actually checked inside Area Financial Organization, or CBO, portfolio.

And so the courtroom’s purchase demands earplug claimants in addition to their lawyer to disclose all third-people litigation investment agreements on the court so you can and make certain you to definitely he or she is fair and you can reasonable. The girl power to interfere in the a 3rd-party bargain lower than county legislation is a bit hazy – however, she actually is a federal court legal and that has some move. To the Saturday, Court Rogers awarded directives for a couple of distinctive line of categories of plaintiffs.

Organizations which have branch practices are required to fill in the fresh survey to the newest FDIC because of the July 30, 2023. Organizations with only a central workplace try excused; yet not, they are included in the questionnaire performance based on the total dumps claimed on their Summer Call Declaration. Publication of your survey information is dependent on prompt and you will precise processing by respondent organizations; thus, no processing extensions will be supplied. The new MMF Screen suggests $step 1.dos trillion otherwise 22% web rise in assets within the 2023, that have authorities finance drawing over three-home of web the newest bucks. Approximately 40% away from net inflows took place March 2023, as the anxiety about the protection from places following the failure of several regional banking institutions caused traders to help you reallocate $480 billion in order to MMFs—the next prominent one to-day increase to the number.

Has just, I was select Treasurer of your Neighborhood out of Elite group Journalists’ SDX Foundation (Arizona, DC chapter), raising scholarship currency to own ambitious young journalists. Matthew try an elder consumer financial reporter with well over a few decades out of journalism and you can monetary features systems, permitting customers create informed choices about their personal finance needs. His banking profession comes with becoming a good banker in the Nyc and a bank officer in the one of several nation’s prominent banking companies. Matthew is now a part of your Panel out of Governors from the the new Community to own Advancing Company Modifying and you will Composing (SABEW), chairing their education representative engagement panel and that is co-couch of its Money Panel. The banking article group continuously evaluates investigation from over a hundred of one’s finest creditors across a selection of classes (brick-and-mortar financial institutions, online financial institutions, borrowing unions and) in order to find the alternatives that really work good for you. Marcus from the Goldman Sachs also provides Cd words anywhere between half a year to six ages, plus the minimal required opening deposit out of $five-hundred is gloomier than some other banking institutions charges.

United states plan stays considering recognizing and you can strengthening a good popular, successful, an initial recipient out of FSA guidance. Us assistance to Ukraine is concentrated to promote governmental and you can financial reform and also to address immediate humanitarian means. The united states features consistently recommended Ukraine’s change to help you a popular neighborhood which have a booming industry-based cost savings. Russian county news claimed one Russian company “Kaysant” create a system to safeguard Russian armored vehicle of first person vision (FPV) drones.71 A Kaysant member stated that the business install an excellent dome-type of drone jammer designed for installation to the automobile and you can weighs just a couple of kilograms. The machine reportedly jams drones from the 800 and you will 900 megahertz wavelengths, and Kaysant plans to produce similar possibilities which can operate on three or four wavelengths. Kaysant apparently began production of these types of possibilities along with received sales in the Moscow government, so there are currently talks about mass shipments of those solutions to the frontlines.

What’s a minimum Put Gambling establishment?

SVBFG’s internal risk cravings metrics, that happen to be lay by their panel, offered limited profile to the their weaknesses. Indeed, SVBFG got broken their a lot of time-name IRR limitations on and off while the 2017 because of the architectural mismatch anywhere between long-stage ties and small-stage dumps. Within the April 2022, SVBFG generated counterintuitive acting assumptions regarding the duration of dumps to help you address the brand new restrict breach unlike managing the real exposure. Along side exact same period, SVBFG along with got rid of interest rate bushes who have protected from ascending interest levels. Inside contribution, whenever rising rates endangered earnings and you can quicker the value of their ties, SVBFG government got procedures to keep up small-label winnings rather than effortlessly perform the underlying harmony sheet threats.

At the time of December 31, 2022, the previous Signature Lender got full deposits of $88.six billion and you may overall assets out of $110.4 billion. The order having Flagstar Lender, Letter.A great., incorporated the acquisition of approximately $38.cuatro billion out of Signature Bridge Financial’s assets, as well as financing of $twelve.9 billion bought at a savings from $2.7 billion. Around $60 billion within the financing will stay in the receivership for later on temper by the FDIC. As well, the brand new FDIC acquired collateral enjoy rights in the Ny Neighborhood Bancorp, Inc., popular inventory which have a possible property value to $three hundred million. Over the same months, within the advice of the Vice Sofa to have Supervision, supervisory methods moved on. In the interview for this declaration, staff several times mentioned alterations in traditional and techniques, in addition to stress to attenuate weight to your businesses, meet a high load out of facts for a good supervisory end, and you may have demostrated due process regarding supervisory tips.

Comentarii recente